![]()

A human resources (HR) compliance calendar ensures that your HR department stays on top of important events, such as tax deadlines, Affordable Care Act (ACA) compliance, quarterly performance reviews, and healthcare deadlines. Our HR compliance calendar can be easily integrated into your Google Calendar or downloaded as a PDF or Excel file, so you won’t miss any important HR events.

FILE TO DOWNLOAD OR INTEGRATE

2024 HR Compliance Calendar

Download as Excel Download as Google Doc

Jan. 8 – FIRE System Available for Online Filing of Form 1099. Under Section 2102 of the Taxpayer First Act, the IRS developed an internet portal that allows taxpayers to electronically file Forms 1099s. Learn more about Filing Information Returns Electronically (FIRE). Jan. 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in December 2023 will need to fill out a Form 4070 and turn that in to their employer. Jan. 31 – Distribute W-2 Forms to Employees. A W-2 form is used to provide important tax information to your employees—including gross pay, federal taxes withheld, state taxes withheld, Medicare taxes withheld, Social Security withholdings, and retirement contributions. You must provide all employees with a copy of their W-2 form before Jan. 31. Provide copies of W-2 forms, along with a W-3 Form to the IRS by Jan. 31. If you need help completing this, head over to our guide on how to fill out a W-2 form.

You may also want to check our W-2 vs 1099 comparison to be sure you are sending the correct form.Jan. 31 – Quarterly IRS Form 941 Due. Form 941 is used to report your employer quarterly payroll taxes to the IRS. We have a step-by-step article on how to fill out Form 941 if you require assistance. Jan. 31 – IRS Form 940 Due (if quarterly FUTA taxes were not paid when due). Form 940 is used to report your annual Federal Unemployment Tax Act (FUTA) tax. Along with state unemployment tax, FUTA tax funds are used to pay unemployment compensation to workers who have lost their jobs. For assistance with filling out this form, visit our FUTA Taxes and Form 940 article. Jan. 31 – IRS Form 944 Due. Small employers (those whose annual liability for Social Security, Medicare, and withheld federal income taxes is $1,000 or less) will file and pay these taxes only once a year instead of every quarter. For help to determine if you qualify and help to fill out the form, visit our How to Fill Out Form 944 article. Jan. 31 – Distribute 1095-B & 1095-C Forms to employees. If you’re an ALE, provide Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, to full-time employees. For all other providers of minimum essential coverage, provide Form 1095-B, Health Coverage, to responsible individuals. Jan. 31 – Distribute Form 1099-NEC. A 1099-NEC form is used to report independent contractor pay information (total amount paid, if $600 or more). You must provide all contract employees with a copy of their 1099-NEC by Jan. 31. The NEC (non-employee compensation) form replaces the former 1099-MISC for reporting independent contractor pay.

Feb. 1 – OSHA Form 300A – Paper Filing Deadline. The Occupational Safety and Health Administration (OSHA) Form 300A is used for employers to record all reportable injuries and illnesses that occur in the workplace. The e-file deadline is in March. Feb. 12 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in January 2024 will need to fill out a Form 4070 and turn that in to their employer. Feb. 15 – IRS Form 940 Due (if quarterly FUTA taxes were paid when due). Feb. 16 – Begin withholding income tax from the pay of any employee who claimed exemption from withholding in 2023, but didn’t give you an updated Form W-4 for the new calendar year (2024). Feb. 28 – Forms 1094-C and 1095-C – Paper Filing Deadline. These forms are used for ACA compliance for applicable large employers (ALE) to report health insurance information. The 1094 form acts as a cover sheet and the 1095 form should be submitted to the IRS. Feb. 28 is the paper filing deadline to ensure your forms are received by the IRS in time. The e-file deadline is in March.

Feb. 28 – Forms 1094-B and 1095-B – Paper Filing Deadline. These forms are used for ACA compliance for self-insured employers (those that do not qualify as an ALE) to report health insurance information. The 1094 form acts as a cover sheet, and the 1095 form should be submitted to the IRS. Feb. 28 is the paper filing deadline to ensure your forms are received by the IRS in time. The e-file deadline is in March.

Feb. 28 – Form 8809 – Paper Filing Deadline. Employers should submit this form to file for an extension to provide certain tax forms, such as W-2 or 1094-C. Submit this form by Feb. 28 for the IRS to receive your request in time. The e-file deadline is in March.

March 1 – Multiple Employer Welfare Arrangement (MEWA) M-1 Form Due. This form is used to report health and other benefits to employees of two or more employers. Report information regarding a multiple employer welfare arrangement and any entity claiming exception (ECE). March 4 – Provide CMS Creditable Coverage Disclosure. A group health plan’s prescription drug coverage is considered creditable if its value equals or exceeds the value of standard Medicare Part D prescription drug coverage. Employers who meet this requirement must provide a disclosure notice to any qualifying employee. March 4 – OSHA Form 300A – E-file Deadline. March 11 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in Feb. 2024 will need to fill out a Form 4070 and turn that in to their employer. March 15 – S-corp (Form 1120-S) and partnership (Form 1065) tax returns due. These forms are used to report income, profits, losses, dividends, and deductions of shareholders (S-corp) and business partnerships. March 15 – Form 8809 – E-file Deadline. March 28 – Conduct Quarterly Performance Reviews. Conducting regular performance reviews of your employees can lead to increased productivity and profitability. Use our Employee Evaluation Forms to keep track of each employee’s performance and review. March 29 – EEO-1 Report. This report is required of all 1) private sector employers with 100+ employees, and 2) federal contractors with 50+ employees meeting certain criteria to submit demographic workforce data, including race/ethnicity, sex, and job category data in compliance with Equal Employment Opportunity (EEO). March 31 – End of Quarter 1.

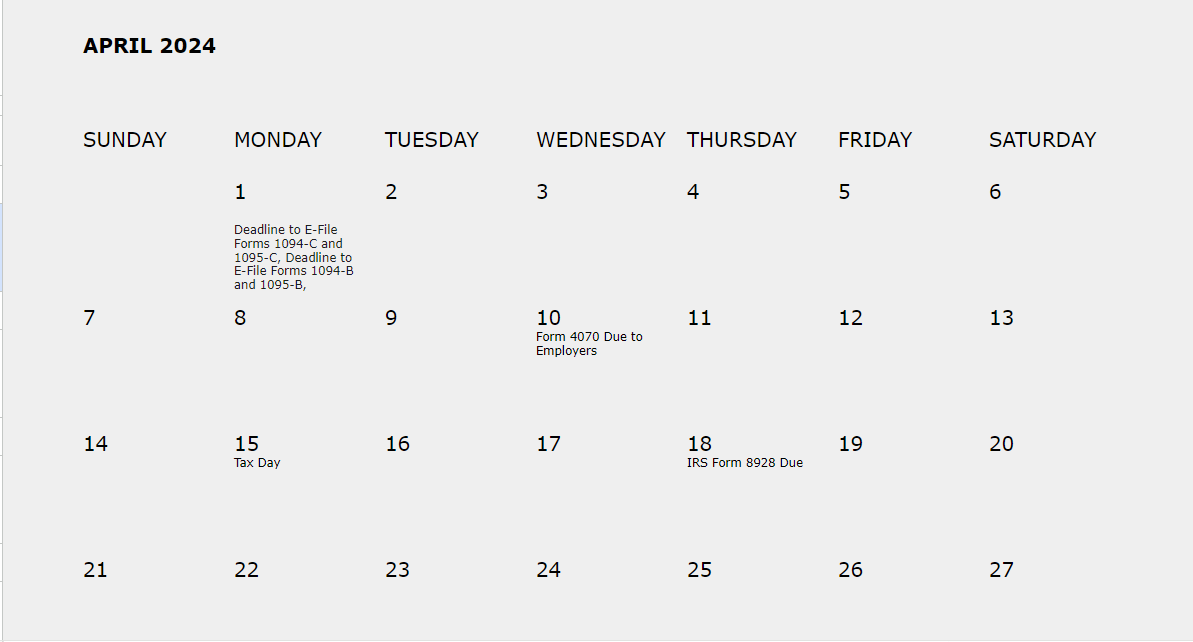

April 1 – Deadline to E-File Forms 1094-C and 1095-C. April 1 – Deadline to E-File Forms 1094-B and 1095-B. April 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in March 2024 will need to fill out a Form 4070 and turn that in to their employer. April 15 – Tax Day (Filing deadline for personal tax returns & C corporations). April 18 – IRS Form 8928 Due. Employers should use this form to self-report COBRA administration compliance failures. April 29 – Summary Plan Description Due. Employers must provide documentation to all employees in retirement plans or health benefit plans covered by the Employee Retirement Income Security Act of 1974 (ERISA).

May 1 – Quarterly IRS Form 941 and Form 720 Due. May 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in April 2024 will need to fill out a Form 4070 and turn that in to their employer. May 15 – Nonprofit Tax Returns Due – Form 990.

June 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in May 2024 will need to fill out a Form 4070 and turn that into their employer. June 28 – Conduct Quarterly Performance Reviews. June 28 – End of Quarter 2.

July 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in June 2024 will need to fill out a Form 4070 and turn that in to their employer. July 15 – Midyear Compliance Check. Use this time to ensure you have all HR compliance paperwork prepared and submitted on time for the first half of the year and to begin preparation on the forms and paperwork required for the second half of the year. July 31 – PCORI Payment Deadline. The ACA has imposed a fee on issuers of specified health insurance policies and plan sponsors of applicable self-insured health plans to help fund the Patient-Centered Outcomes Research Institute (PCORI). These payments will be due by any company with 50 or more full-time equivalent (FTE) employees. July 31 – Quarterly IRS Form 941 and Form 720 Due. July 31 – IRS Form 5500 Due. The 5500 form is used to report information about your 401(k) plan’s financial condition, investments, and operation to ensure compliance with government regulations. Details and the form are typically provided by your 401(k) provider. For help in filling this in, read our IRS Form 5500 guide. July 31 – IRS Form 5558 Request for Extension Due. Request for an extension for additional time to file employee plan returns (such as the Form 5500).

Aug. 12 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in July 2024 will need to fill out a Form 4070 and turn that in to their employer.

Sept. 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in Aug. 2024 will need to fill out a Form 4070 and turn that in to their employer. Sept. 13 – Begin Annual Healthcare Coverage Review. If your healthcare coverage plan is set for a Jan. 1 renewal date, begin the process of reviewing your current coverage and speak with your healthcare provider to plan for the next year. If your annual plan falls under a different month, set your calendar reminder for three months prior. Review our article on the 4 major types of benefits to learn more about providing healthcare coverage to your employees. Sept. 30 – PTO Balance Check for Employees. Remind your employees to check their paid time off (PTO) balances before Quarter 4 begins and to submit requests for the remainder of the year in a timely manner. Sept. 30 – Summary Annual Report (SAR) Due. Summarizes employees’ information that appears in an ERISA plan’s Form 5500. Admins must furnish SARs within nine months after the end of the plan year. Sept. 30 – Conduct Quarterly Performance Reviews. Sept. 30 – End of Quarter 3.

Oct. 3 – QSEHRA Notice Deadline. Distribute a notice for Qualified Small Employer Health Reimbursement Arrangement (QSEHRA), a health cost reimbursement plan that can be offered by small business employers. This is for plans that begin Jan.1, 2024. Oct. 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in Sept. 2024 will need to fill out a Form 4070 and turn that in to their employer. Oct. 11 – Medicare Part D – Notify Eligible Employees. Oct. 31 – Quarterly IRS Form 941 and Form 720 Due.

Nov. 1 – FSA Reminders. Send employees a reminder to submit any Flexible Spending Account (FSA) receipts and supporting documentation for reimbursement before year-end. Nov. 1 – Encourage employees to fill out a new Form W-4 or Form W-4(SP) for 2025 if they experienced any personal or financial changes. Nov. 12 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in Sept. 2024 will need to fill out a Form 4070 and turn that in to their employer.

Dec. 10 – Form 4070 Due to Employers. Any employee who received $20 or more in tips in Nov. 2024 will need to fill out a Form 4070 and turn that in to their employer. Dec. 13 – Conduct Annual Compliance Audit. The last month of the year is a perfect time to conduct an audit of your company’s compliance. Dec. 20 – Review Company Policies. The end of the calendar year is an excellent time to review your current policies in place and update your employee handbook. Dec. 20 – Schedule employee safety training for Jan. 2024. Dec. 31 – Workplace Poster Requirements. Every year, you should replace the required workplace posters with updated posters. These include FLSA compliance, OSHA compliance, FMLA compliance, EEO, USERRA, and any others required by your specific state or type of business. Dec. 31 – Distribute Company Calendar. This is the time to update your company holiday PTO calendar for the next year and note any internal highlights (such as birthdays and performance reviews). Distribute your updated calendar to all employees before the end of the year. Dec. 31 – Conduct Annual Performance Reviews. Dec. 31 – End of Quarter 4.

Missing important deadlines can have monetary consequences. To avoid these mishaps, you should prepare compliance paperwork and forms in advance. Download our 2024 HR Compliance Calendar to stay on track throughout the year.

Find Jennifer On LinkedIn

Jennifer Soper has 25+ years of writing and content design experience, working with small businesses and Fortune 100 companies. For over a decade, Jennifer worked as an HR generalist, providing expertise in accounting, payroll, and HR by implementing payroll and benefits best practices and creating onboarding and employee-relations documentation.